Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Investment Services, Annuities

Michelle Kuschel

Office Hours

After Hours by Appointment

Address

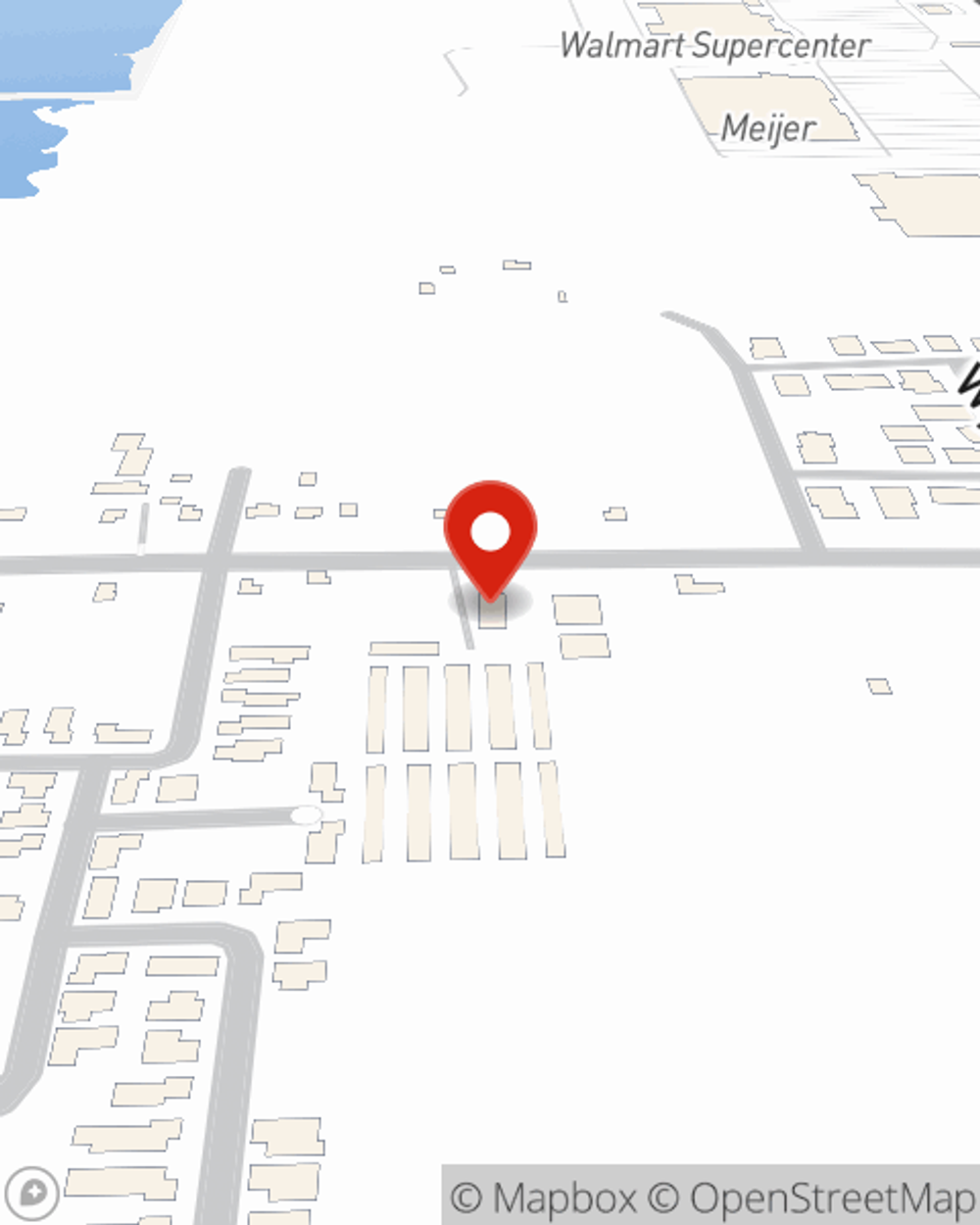

Fort Gratiot, MI 48059-3412

Between Port Huron Drywall and Keewahdin Mini Storage

Would you like to create a personalized quote?

Would you like to create a personalized quote?

Office Info

Office Info

Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

-

Phone

(810) 479-9014

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Investment Services, Annuities

Office Info

Office Info

Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

-

Phone

(810) 479-9014

Languages

Simple Insights®

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

Make your windows energy efficient

Make your windows energy efficient

Make your windows energy efficient with simple DIY updates, such as installing storm windows and sealing air leaks with caulk or weather stripping.

In the market for a classic car? Here's the buyer's guide you need

In the market for a classic car? Here's the buyer's guide you need

Buying a classic or antique car might be one of the most exciting purchases you'll make. Check out some helpful tips to help you through the process.

Social Media

Viewing team member 1 of 5

Jessica Mitchell

Office Manager

License #17248129

With over ten years of experience in the insurance industry, I proudly serve as the Office Manager at [Insurance Agency Name]. My extensive background has equipped me with a deep understanding of insurance products and customer service, allowing me to effectively oversee daily operations and ensure our customers receive the highest level of support.

In my role, I am responsible for coordinating our team’s efforts to provide exceptional service and streamline processes. I take pride in fostering a positive work environment that encourages collaboration and growth, ensuring that our staff is well-equipped to meet the diverse needs of our customers.

My commitment to excellence drives me to stay updated on industry trends and regulations, enabling our agency to provide comprehensive insurance products that protect our customers’ interests. I believe in building strong relationships with our customers, understanding their unique circumstances, and guiding them toward the right coverage options.

Outside of my professional responsibilities, I am passionate about community involvement and enjoy participating in local events that promote safety and financial literacy. I look forward to continuing to support our customers and helping them secure a brighter future through the right insurance products.

Feel free to reach out to me for assistance or guidance regarding your insurance needs!

Viewing team member 2 of 5

Jennifer Buckhana

Insurance Account Representative

License #19729032

With over twenty years of experience in customer service, Jennifer brings a wealth of expertise to our team. She recognizes the importance of making our customers feel valued through personalized attention. Jennifer is an excellent listener, which enables her to gather essential information about our customers' needs and help them navigate their insurance policy options.

Her extensive knowledge of the insurance industry continues to expand through ongoing training and experience. If you have questions or concerns regarding home or auto insurance, Jennifer is a great resource. Her comprehensive understanding of the business allows her to provide valuable insights and guidance to our customers.

We are truly fortunate to have Jennifer on our team, as she consistently goes the extra mile to ensure our customers receive the outstanding service they deserve. Her dedication and commitment to their satisfaction are unparalleled.

Viewing team member 3 of 5

Erin Curtiss

Customer Relations Representative

License #19973056

With over thirty years of experience in customer service, Erin exemplifies professionalism and recognizes that building a successful business goes beyond merely attracting new customers. She strongly believes in the importance of nurturing ongoing relationships and delivering exceptional service. In the insurance industry, our aim is to create lifelong connections with our customers, and Erin excels at this.

Erin takes immense pride in guiding our customers through the ever-changing landscape of insurance. She approaches her role with genuine care and concern for each customer's unique needs and goals. Her dedication to providing personalized support is evident in every interaction.

We greatly value Erin's expertise and the positive impact she has on our customers' experiences. Her commitment to professionalism ensures that customers receive the highest level of attention and assistance as they navigate the complexities of insurance. With Erin by their side, our customers can feel confident that their needs are in skilled hands.

Viewing team member 4 of 5

Kay Clarke

Customer Service Representative

Kay began her journey with our agency as a part-time service team member, and we are thrilled to have her with us more frequently now. She is dedicated to ensuring that our customers' policies are kept in good standing and that their forms are current, a task that can be quite challenging in today's fast-paced environment.

Managing policies and paperwork can be overwhelming, especially with the increasing demands of our busy lives. However, Kay approaches this responsibility with diligence, working tirelessly to ensure that our customers' insurance needs are addressed promptly and efficiently.

We truly appreciate Kay's commitment and dedication to providing outstanding service. Her contributions play a vital role in the smooth operation of our agency and help us maintain our standard of delivering exceptional support to our valued customers.

Viewing team member 5 of 5

Ashley Roeske

Personal Account Representative

License #21207527

We are excited to introduce our phenomenal summer intern, Ashley, who has made a remarkable impact during their time with us at Michelle Kuschel State Farm. With a strong eagerness to learn and a proactive attitude, Ashley has quickly become an invaluable part of our team.

Throughout the summer, [Intern's Name] has immersed themselves in various aspects of our operations, gaining hands-on experience in customer service, policy management, and insurance processes. Their enthusiasm for the insurance industry and dedication to providing exceptional support to our customers is truly commendable.

Ashley has demonstrated exceptional problem-solving skills and a keen attention to detail, which have significantly contributed to our team’s efficiency and effectiveness. They have shown a natural ability to connect with customers, ensuring their needs are met and providing them with the information they need to make informed decisions.

We are hopeful that Ashley will join us as a permanent team member, as their fresh perspective and commitment to excellence align perfectly with our agency’s values. We look forward to seeing how [Intern's Name] will continue to grow and thrive in the insurance industry.

Please join us in celebrating Ashley's achievements and potential as they embark on a promising career in insurance!